Resilience Amid Rising Rates:

GTA’s ICI Land Market in Oakville, Burlington & Hamilton

In the last three years, the Greater Toronto Area (GTA) has witnessed remarkable growth in the sale of Industrial, Commercial, and Institutional (ICI) land, with a significant spike in acres sold across Hamilton, Burlington, and Oakville. As we have seen throughout the years, a surge in demand inevitably accompanies a rise in costs. This principle holds true for the ICI land market in the GTA. Over the past 2 years there has been an increase in volume and average price per acre for ICI land sales. Remarkably, even amidst a rising interest rate environment, prices have remained resilient, showing no signs of decline despite a more recent decrease in transaction volumes. This intriguing phenomenon challenges conventional market trends, underlining the unique dynamics at play in the current land market.

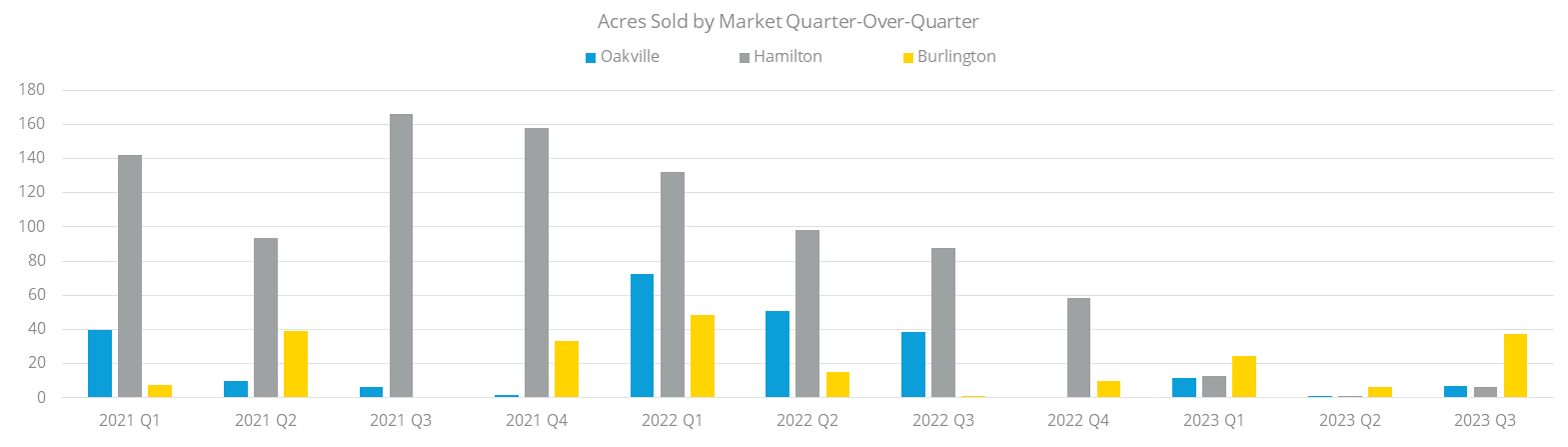

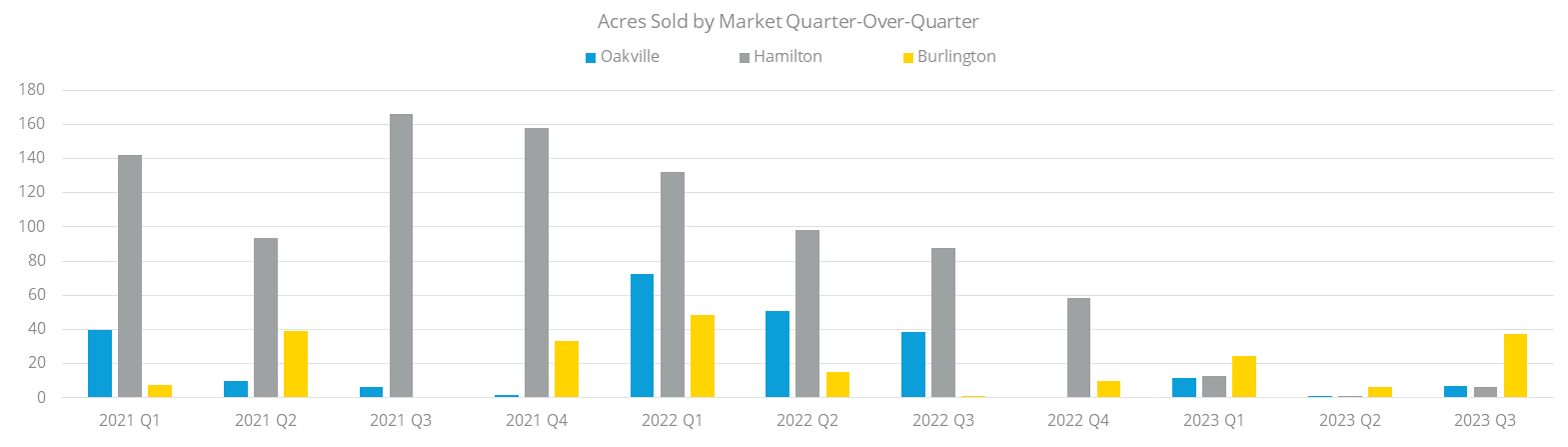

One of the pivotal factors fueling this boom was the shift towards e-commerce. The onset of the pandemic necessitated rapid adaptation, compelling retailers, and businesses to bolster their online presence. This surge in e-commerce translated into an unprecedented demand for warehousing space, amplifying the need for new industrial properties. In the fourth quarter of 2019, the availability rate for industrial space throughout the GTA stood at a mere 1.1%. This figure underscored the GTA’s status as a robust landlord’s market, characterized by considerable supply constraints. The onset of the pandemic further exacerbated these challenges, intensifying the demand for new warehousing space. The pressing need for additional storage facilities became glaringly evident amid these circumstances, driving the urgency for further developments in the industrial real estate sector. As a response to this growing demand, developers strategically acquired land, peaking at 250 acres sold in a quarter across Hamilton, Oakville, and Burlington (see below).

A Challenging Market

In today’s more challenging market, the GTA’s ICI land market has been sustained by well-financed owner-user groups. These entities continue to invest in land and develop properties tailored to their specific needs. What’s noteworthy is not just their willingness to purchase land but also their ability to do so at prices akin to those during the peak of ICI land sales. Creative solutions, including vendor-takeback-mortgages (VTBs), have been instrumental in sustaining these prices. Our research indicates a 6% quarter-over-quarter growth in the price per acre for ICI land across Hamilton, Oakville, and Burlington from Q2 2023 to Q3 2023, exemplifying the resilience of this market. At Team Murray & Faldowski we have compiled what we feel are the most recent and most applicable owner-user land sales in every region across the GTA west of Peel, along with the average price per acre. The results can be found in the graphic below.

While the industrial real estate sector faces challenges, including low availability rates and increased costs, it also presents exciting opportunities for investors, developers, and businesses. As we move forward, understanding the intricate balance between demand, supply, and innovative financial solutions will be crucial. The ability to adapt to evolving market dynamics and leverage creative approaches will define the success of stakeholders in the ICI land market. If you have any inquiries regarding the information provided above or if you have specific real estate needs, please feel free to reach out to myself or any of our highly capable agents at Team Murray & Faldowski.

By: Philip Vargas, Data Analyst & Market Data Coordinator, Colliers Canada

Resilience Amid Rising Rates:

GTA’s ICI Land Market

SUBSCRIBEResilience Amid Rising Rates:

GTA’s ICI Land Market in Oakville, Burlington & Hamilton

In the last three years, the Greater Toronto Area (GTA) has witnessed remarkable growth in the sale of Industrial, Commercial, and Institutional (ICI) land, with a significant spike in acres sold across Hamilton, Burlington, and Oakville. As we have seen throughout the years, a surge in demand inevitably accompanies a rise in costs. This principle holds true for the ICI land market in the GTA. Over the past 2 years there has been an increase in volume and average price per acre for ICI land sales. Remarkably, even amidst a rising interest rate environment, prices have remained resilient, showing no signs of decline despite a more recent decrease in transaction volumes. This intriguing phenomenon challenges conventional market trends, underlining the unique dynamics at play in the current land market.

One of the pivotal factors fueling this boom was the shift towards e-commerce. The onset of the pandemic necessitated rapid adaptation, compelling retailers, and businesses to bolster their online presence. This surge in e-commerce translated into an unprecedented demand for warehousing space, amplifying the need for new industrial properties. In the fourth quarter of 2019, the availability rate for industrial space throughout the GTA stood at a mere 1.1%. This figure underscored the GTA’s status as a robust landlord’s market, characterized by considerable supply constraints. The onset of the pandemic further exacerbated these challenges, intensifying the demand for new warehousing space. The pressing need for additional storage facilities became glaringly evident amid these circumstances, driving the urgency for further developments in the industrial real estate sector. As a response to this growing demand, developers strategically acquired land, peaking at 250 acres sold in a quarter across Hamilton, Oakville, and Burlington (see below).